Tazama is an open-source, real-time transaction monitoring software built to

support any financial service provider (FSP) that requires transaction monitoring for fraud and money laundering detection. Whether that FSP is a small provider running one or two transactions per day or a national payment switch running thousands of transactions per second, with Tazama you can implement simple or complex rules and fraud detection controls and support anti-money laundering activities.

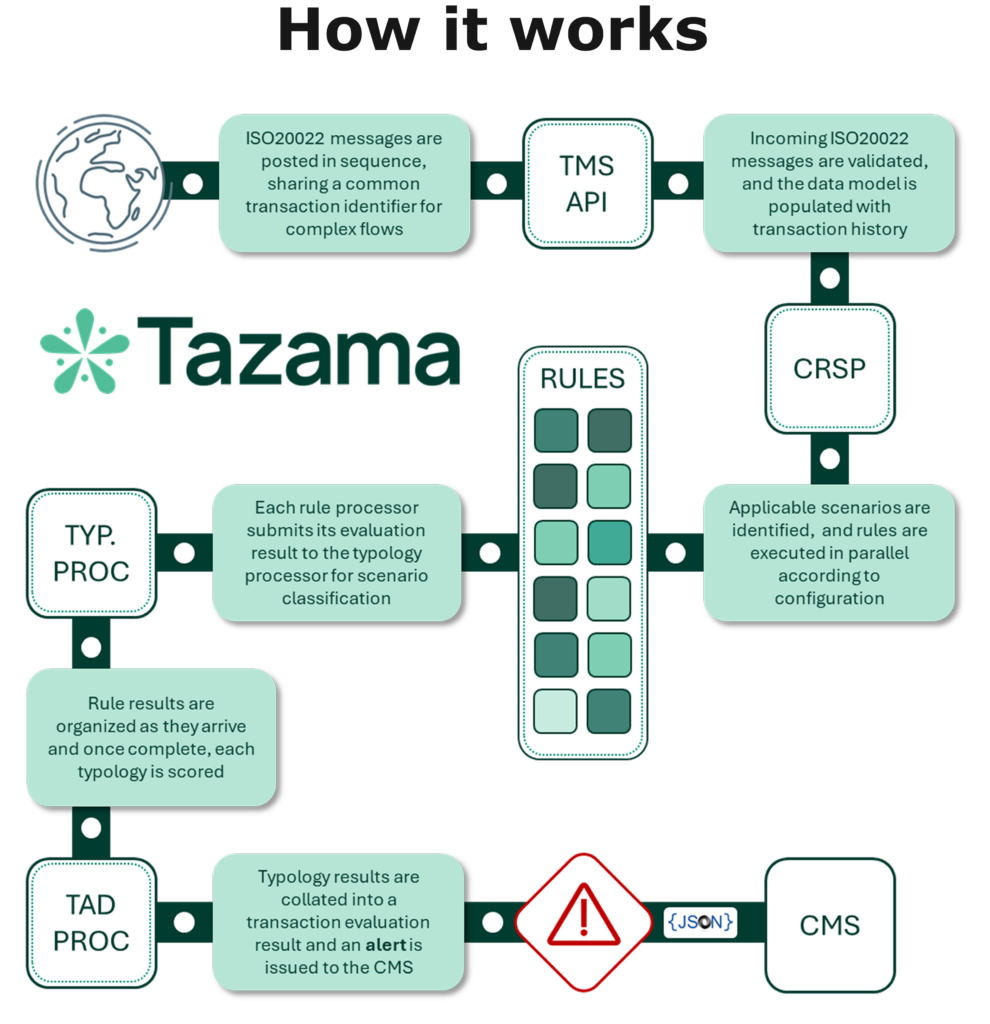

Tazama is designed to ingest transaction data in real-time through its Transaction Monitoring Service API. Data can be received from multiple participants in a financial ecosystem, including customer-facing financial service providers such as banks, remitters or mobile money operators, and also the intermediaries involved in facilitating transfers and payments across the ecosystem, such as clearing houses or payment switches. The Tazama API is designed to be ISO20022 compliant, but non-ISO20022 systems can still communicate with the platform via a Payment Platform Adapter that

will transform message traffic into an ISO20022 equivalent.

Ingested transactions are stored in the Tazama database from where it will be used to support real-time modelling of participant behavior through a number of rule processors that will evaluate the transaction and its participants to look for suspicious behavior. Rule results will be summarized into fraud and money-laundering scenarios, called typologies.

If the rules and typologies show evidence of suspicious behavior, an investigation alert will be issued to an external case management system and in extreme cases, the transaction can also be blocked to prevent the transfer of funds and financial loss by the intended victim.